A family owned farm

Chatterson Farms is a family owned sustainable farm located on 5 acres in beautiful Clermont Florida. We produce fruits, vegetables and fish together in a closed symbiotic environment…a growing method known as Aquaponics. Ryan & Katie Chatterson’s dream is to offer the best and healthiest range of organic foods available, promote health in the community and bring a sense of discovery and adventure into food shopping.

Visit our Products for a complete list of fresh, aquaponic produce we are offering.

What is it?

Resource Saving!

Future of Farming!

Better Taste!

What we do

We Grow, Design, Build & Teach!

Chatterson Farms

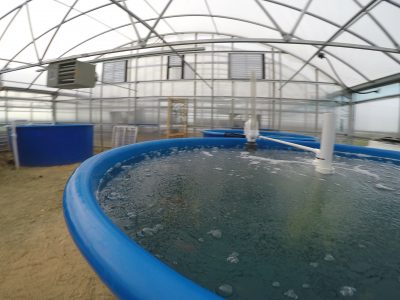

We have designed and built our Aquaponic Farm that produces superior quality produce and fish. Taste the aquaponics difference!

Aquaponic Engineering & Design

We design and build custom aquaponic systems to fit your needs. Turn-key systems are also available in a variety of sizes!

College of Aquaponics

Want to learn how to design and run your own aquaponic farm? Get 24 hours of on-demand training online!

Our turn-key systems have been designed to be robust, durable, long lasting and extremely productive. The technology used in these patent pending production systems has been tested and PROVEN to work!

We have several options depending on your skill level, market, location as well as the option to purchase a greenhouse for the production system. We can also install the system or greenhouse!

Click here to shop our Turn-Key Aquaponic Systems or Contact Us for a Custom Design Quote: